The cost of all the legal billable hours spent creating this dreck (and reading it!) could probably have been better spent rebuilding Puerto Rico's devastated electrical system.

Blah, blah, blah, little commenters. As if.

So, I looked at the docket. Read very, very few. You can probably limit your review to scrolling through the docket sheet. Here's a few things I gleaned from my own scroll...

FirstEnergy should probably get some sort of award for "inspiring" the greatest number of comments from "independent" third parties, all concocted in perfect legal prose. Who actually wrote all these? And will the cost of such find its way into my electric bill?

The Nuclear Information & Research Service should probably get its own award for being a major factor in crashing FERC's e-filing system on comment deadline day. Comment in 76 separate parts? Was that really necessary? It must have taken the filer all day to accomplish that. And I thought filing testimony and exhibits in 20 parts was trying on the patience, once upon a time. Seventy-six (76!) parts. At least it made scrolling through a certain part of the docket a lot faster. What were these 76 parts, anyhow? Layperson comments. Gushing on about clean energy. Some which predated the NOPR by months. Now couldn't this commenter have filed these 76 parts earlier to avoid this congestion on deadline day? Couldn't all of these commenters have avoided congestion by filing their comments earlier? A deadline is just that... a deadline. It doesn't prevent earlier participation. Lawyers love playing the deadline game, an exercise in not showing yours until the other parties show theirs -- legal chicken. While waiting until the last minute to file may have some purpose in preventing other parties from using your filing to bolster their own, in this NOPR it was pointless. The only thing these commenters accomplished, apparently, was crashing FERC's e-filing system. I pity the poor soul who was trying to get something filed on another docket that day.

Some of the comments attempted ad hominem arguments that we must build more transmission to achieve "resilience." Build, build, build, a bigger, more diverse network of vulnerable energy links is just what we need. (Thanks, WIRES, you're nothing if not trying to fill your own pockets. Every.single.day.) But what good is a pile of wire if it's not connected to a generator?

The only comment worth reading was written by Amory Lovins of the Rocky Mountain Institute. Not only is it a fresh, entertaining joy to read, it tells FERC (and DOE, and all the other commenters!) everything they need to know about "resiliency." Such as:

The design principles and practices that create energy resilience (or, as the Secretary calls it, resiliency) were first framed for the Pentagon in 1981, and still broadly guide DoD doctrine for resilient power supplies to military bases and other facilities critical to national security. These principles do not include continued or enhanced reliance on inherently vulnerable powerlines hauling electricity hundreds of miles from remote central power stations—a system rife with single points and modes of failure requiring costly redundancies but still not fully effective, as these comments elaborate. Such grid-dependence is the largest factor preventing electric resilience.

Rather, resilient design logically starts at the customer and works back up the supply chain, seeking to make that chain as short as possible and each of its links robust, redundant, with graceful failure and quick rerouting or repair. As a lay summary of Brittle Power explained, a resilient system “has many relatively small, dispersed elements, each having a low cost of failure. These substitutable components are interconnected not at a central hub but by many short, robust links. This configuration is analogous to a tree’s many leaves, and each leaf’s many veins, which prevent the random nibblings of insects from disrupting the flow of vital nutrients.”

Thus the NOPR’s obsession with continuity of fuel supply to generators—even if 2.1–2.4’s rebuttals below were invalid—ignores the grid. Yet any rational treatment of electric reliability and resilience must focus primarily on the grid.

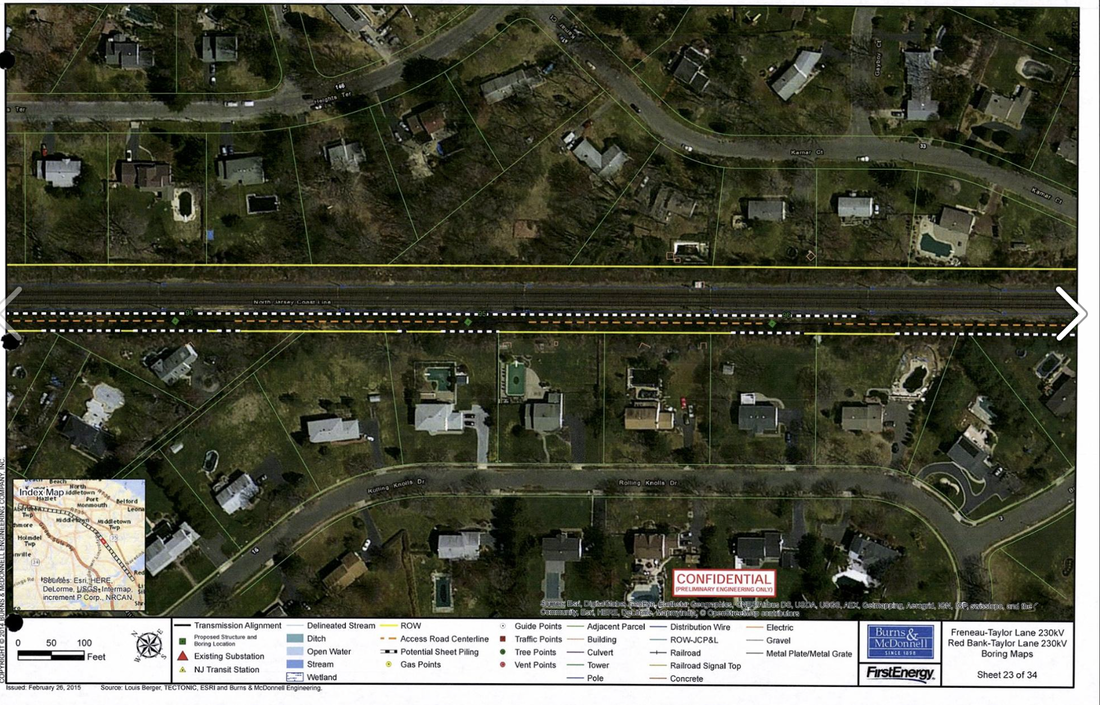

The Electric Power Research Institute long ago estimated, and modern data agree, that roughly 98–99% of power failures originate in the grid, and ~90–95% of those in the distribution grid. As the NOPR’s §II(A) rightly notes, America’s grid comprises 707,000 miles of high-voltage transmission lines, 55,800 substations, and 6.5 million miles of local distribution lines. All are interruptible by high winds, lightning, ice storms, tree limbs, cars crashing into power poles, squirrels, birds, operator errors, fires, solar storms, electromagnetic pulses, cyberattacks, or rifle bullets.

As I write this, about three million Puerto Rican American citizens face months of further blackout, with only 16% returned to service after three weeks, because a hurricane destroyed their grid, even though their 98%-fossil-fueled utility has ample and available generating capacity with adequate fuel on hand. The NOPR is irrelevant to them and to the other Americans blacked out in Texas by Harvey, Florida by Irma, the Virgin Islands by Irma and Maria, etc. Hurricane Maria’s grid destruction in Puerto Rico alone has already about doubled in 2017 the total outage customer-hours experienced nationwide in 2016.

Yet the NOPR says and does nothing about the brittle grid connecting power plants to customers—only the virtual non-problem of how big a pile of coal sits at each plant. The NOPR does vigorously seek to prevent and reverse the competitive market exit of outdated plants typically sited half to several states away from customers, hence inherently vulnerable to grid failure. The NOPR’s effort to reverse the market-driven decentralization and diversification of historic grid dependence would weaken national security: since grid failures dominate total failures, any electricity strategy that perpetuates and increases reliance on remote central power plants, no matter how reliable they are, will increase vulnerability and reduce resilience.

The answer? Distributed generation -- power generation near users that relies on its diverse nature to prevent widespread blackout due to the failure of one generator.

Central station generators and a long network of fragile transmission and distribution lines (which includes any aerial connection, no matter how old) are last century's "resiliency."

How much more time and money will our government and its investor owned-utility masters waste on this manufactured problem? As much as you give them, little ratepayer, since you're paying for this entire debacle. Nothing to see here... let's move on.

RSS Feed

RSS Feed